Trio of deals to fully let 110 Marylebone

Sequoia Capital, Silverstream Technologies and Ashby Capital each signed 10-year leases

The Howard de Walden Estate has fully let 13,000 sf ft of Grade A office space at its 110 Marylebone development located at 1 St Vincent Street, W1.

The development comprises four floors and is the latest offering in the Estates diverse portfolio of office buildings.

Two of the floors, a total of 7,200 sq ft has been let to US venture capital firm, Sequoia Capital. A further 3,100 sq ft has been let to leading maritime tech company, Silverstream Technologies, while UK real estate investor Ashby Capital has signed for the remaining 2,600 sq ft.

All have signed 10-year terms, demonstrating the continued appeal of Marylebone Village despite the ongoing impact of the pandemic.

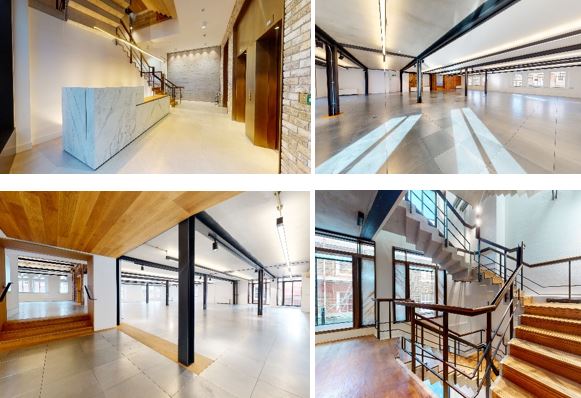

110 Marylebone occupies the corner where Vincent Street meets Marylebone High Street and is situated amongst the renowned amenities and excellent transport links of Marylebone Village. It is the result of an extensive refurbishment to the pre-existing corner building and the construction of a new rear extension. The development retains the period features from the original structure and combines these with a contemporary industrial aesthetic.

Head of Commercial Lettings Richard North commented:

“This is a really unique building and we received a high level of interest from potential occupiers before practical completion, with all floors receiving offers early in the New Year.

“We’re delighted to have secured Sequoia, Ashby Capital and Silverstream Technologies as exciting, new occupiers from multiple sectors, demonstrating the enduring appeal of Marylebone and high quality office space, despite the disruption caused by Covid-19. The pandemic has really brought companies’ needs into sharp focus - employers and employees alike are looking for a better quality environment to work in, as well as somewhere that makes the office more of a destination where people want to be, rather than where they have to be.”

Edward Charles & Partners advised The Howard de Walden Estate. BNP Paribas acted for Sequoia Capital, Knight Frank acted for Silverstream Technologies and Ashby Capital were unrepresented.